Within the field of a nation’s economy, commercial banks stand up as formidable pillars,...

Month: April 2024

Venture banking is normally set something to the side for associations and tremendous associations...

Investment banks support public and private projects in getting will keep up in the...

Investment banking has been a basis of your financial business, assisting capital allocation, mergers...

Project managers must be able to resolve problems quickly and effectively. Project managers must...

In the era noted by economic volatility and unrivaled difficulties, commercial banks find themselves...

If you maintain any store wall plug or store, it acts a lot of...

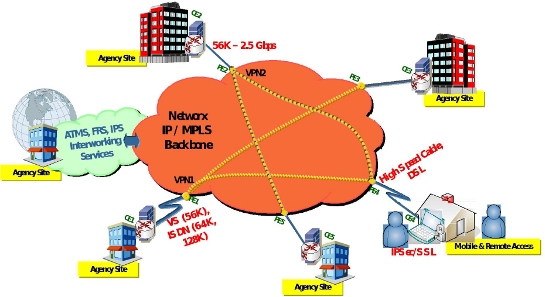

Efficient DevOps practices are essential for modern software development, enabling teams to streamline development...